Friedlgasse 39

Return

4.85% p.a.

Duration

48 months

Project type

Income

Distribution

Quarterly

Notice according to § 12 (2) Vermögensanlagengesetz

This investment involves considerable risk and may result in partial or total loss.Project Presentation

The property "Friedlgasse 39" is an apartment building in the middle of the best location in the 19th district with a net floor space of 580m². The residential building extends over basement, ground floor, 1st floor, 2nd floor, 1st attic and 2nd attic and has five units, which are divided into four apartments and a surgery. It is already very well occupied with several anchor tenants and currently generates a net annual rent of around €84,000.

The good residential location in the 19th district impresses with a quiet environment and yet has an excellent infrastructure. Bus and streetcar lines as well as supermarkets, pubs, various stores and sports facilities are within walking distance. This also makes the property popular with tenants, as the apartment building has almost no vacancies.

The property owner and asset manager is CAELIA Estate GmbH.

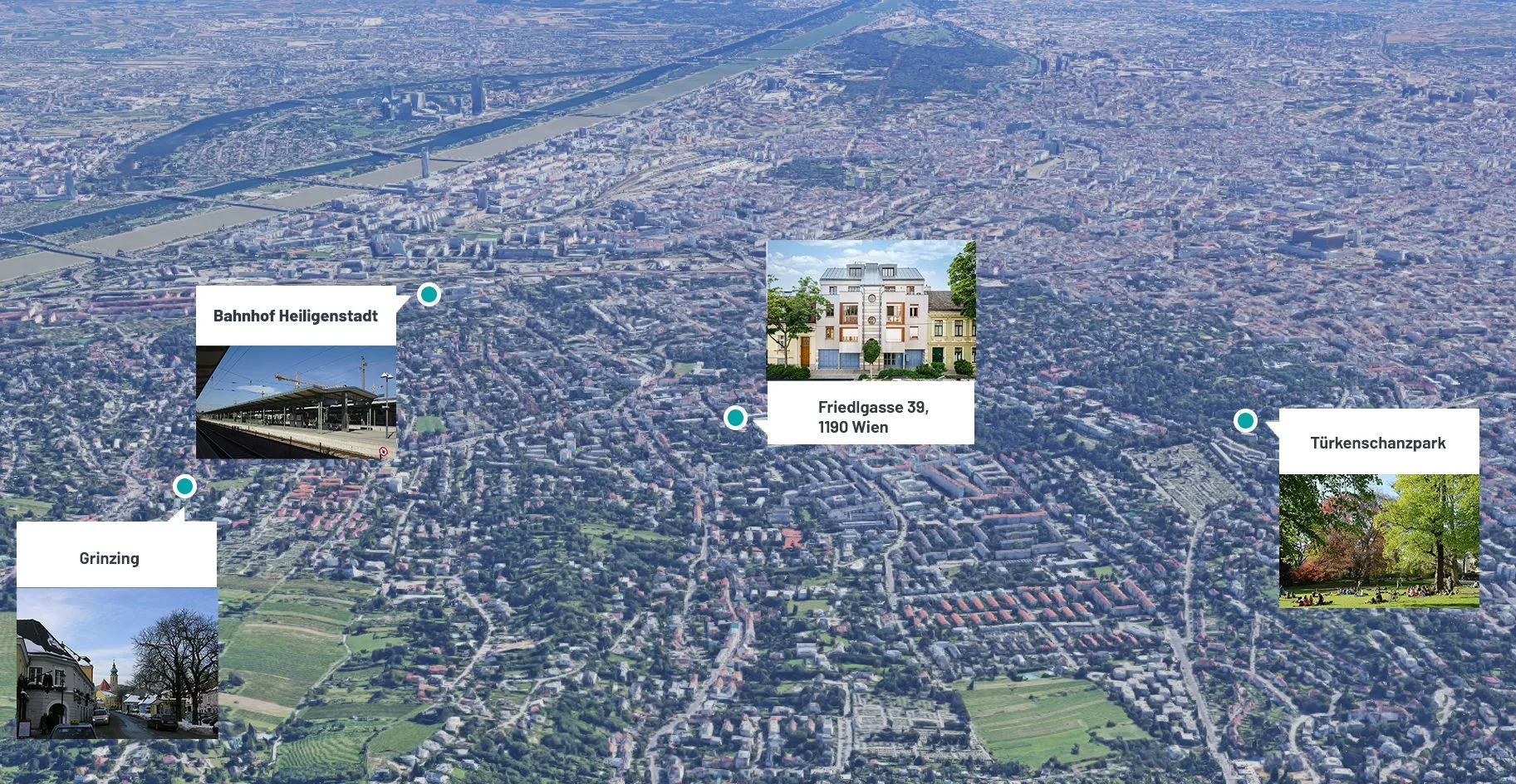

Location

Discover the surroundings

Friedlgasse 39 is located in the heart of Döbling. The apartment building is in a very good location near the Döbling Cottage district. The immediate proximity to recreational areas means that this location offers both recreation through green spaces and local recreation areas as well as the amenities of a modern district with extensive social, educational, cultural and sports facilities as well as various local supply options. Connections to the public transport network are also provided by bus lines and the Oberdöbling subway station.

Kahlenberg

The Kahlenberg is part of the Vienna Woods and is one of Vienna's sights as well as a traditional Sunday excursion destination for the Viennese, since from the Kahlenberg one has a view of all of Vienna and, with good visibility, as far as the Little Carpathians in Slovakia or the Schneeberg in the Styrian-Lower Austrian Limestone Alps. Its peak overlooks the Vienna Basin by about 320 meters. From the Stefaniewarte, which is located on the highest point of the mountain, you can also see parts of Lower Austria. Next to the observation tower, which carried broadcasting antennas from 1953 to 1956, there is a 165-meter-high guyed steel tube mast of the ORF, which is used for broadcasting TV and FM programs as well as for directional radio purposes. This transmission mast, erected in 1974, supports elevated operating rooms (which is atypical for such constructions) and has shaped the appearance of Kahlenberg ever since.

Krapfenwaldlbad

The Krapfenwaldlbad in Vienna's 19th district can count itself among the most popular swimming pools in Vienna. This is certainly due in large part to the location of the Krapfenwaldbad, namely practically in the middle of a pine forest, from which the name of the swimming pool is derived. The proximity to the forest sometimes has the great advantage that there are many shady places in the Krapfenwaldbad, which can provide a little refreshment and coolness on hot summer days. In the middle of the forest, numerous attractive playgrounds have been built around a large playground, including the classics such as a slide and a sandbox. Since the two children's pools are directly adjacent, it is easy to keep an eye on the kids.

Neustift am Walde

Neustift am Walde in Döbling, known for its excellent wines and the associated Buschen Schänken and Heurigen. A wine hiking trail along the vines, which are perfectly lined up on the Neustift hills, with its information boards invites you to an instructive walk. The wine taverns present themselves in their entire range of styles from celebrity wine taverns to contemplative Buschenschank. Countless relics from new and old times bear witness to wine-making processes as well as lively festivities. The public ranges from regulars to mass tourists.

Türkenschanzpark

Türkenschanzpark is a park in Vienna's 18th district of Währing. The park was opened in 1888 on the Türkenschanze. Türkenschanzpark is located on a historical site. Here was a redoubt of the Turks in 1683 in the course of the Second Vienna Turkish Siege. Nevertheless, the name of the area poses a mystery, since a topographical representation from 1649 already noted the area as "Türkenschanz". Presumably, the naming goes back to the First Vienna Turkish Siege, but there are no descriptions or references to it.

Team

With a young but experienced and motivated team, the CAELIA Group has been active in the real estate industry for almost eight years, with a management team that can already look back on 15 years of experience in real estate and finance. In addition to Sales/Agency, responsible for purchasing and distribution, and Capital, responsible for releasing capital by handling sale and rent back transactions and joint ventures, CAELIA has focused mainly on real estate development in two areas that make up the Investment division:

The development of projects, mainly residential projects in the early stages, that is, at most until the building permit is obtained. This includes the search and purchase of suitable plots and projects as well as the preparation for construction including planning, dedication and project concepts.

The development of apartment buildings including planning of extensions.

In addition to its own team, CAELIA is supported by a network of strategic partners and service providers with whom it has long-standing relationships. In all areas, CAELIA always acts as a partner for developers and not as a competitor: projects and properties are optimally prepared and prepared for further development or implementation by various developers through CAELIA's pre-development services. Thus, property developers can concentrate on their core competence - the construction of living space. CAELIA is the ideal partner for developers when it comes to the search for land, the preparation of plans and concepts, the financing of projects and the distribution and sale of projects.