Bahnhofstraße 14

Return

4.5% p.a.

Duration

36 months

Project type

Income

Distribution

Quarterly

Notice according to § 12 (2) Vermögensanlagengesetz

This investment involves considerable risk and may result in partial or total loss.Project Presentation

The property is a fully let existing building in a prime location in Plauen. The well-kept house from the Wilhelminian period is located in the middle of the pedestrian zone in Plauen and comprises three residential units and three commercial units. The total usable space of the house is 1,005 m² and it currently generates a net annual rent of around EUR 60,000, which corresponds to a net rent of just under EUR 5/m². Embedded in Plauen's pedestrian zone and in the immediate vicinity of important national and international chain stores, the building is in a sought-after location, from which all tenants in the building benefit. Due to this exceptional location, a long-term lease agreement was concluded with the international chain store Ernsting's family for more than 40% of the floor space in the building.

Plauen is a city with about 65,000 inhabitants in the southwest of the Free State of Saxony. It is the fifth largest city in Saxony and is known for the embroideries known as Plauen lace. First mentioned in a document as early as 1122, Plauen developed into an important trading centre in the Middle Ages and, from the 18th century onwards, into an important Saxon location for the fabric and textile industry. Plauen was considerably affected by bomb hits in 1945, but was mostly rebuilt.

Location

Plauen is a large district town in the southwest of the Free State of Saxony and is located in the Vogtland district. Plauen is the largest city of the Saxon Vogtland and fifth largest city in the Free State. The town became famous for its embroideries known as "Plauener Spitze" (Plauen lace) and is today considered to be architecturally attractive.

Already in the Middle Ages the town was a trading centre and from the 18th century onwards an important location for the Saxon textile and cloth industry, which was accompanied by a strong population growth. In the 1920s, the industrial structure of the city shaped the manufacturing industry in the mechanical engineering sector. Plauen was considerably damaged by bombing in 1945 but could be rebuilt for the most part. A large part of Plauen's centre is characterised by urban, metropolitan development of the 19th century, whereby the town's landmarks are the Old Town Hall with its Renaissance gable and the art clock as well as the Johanniskirche.

The best house on the square

In keeping with the MAGAN Group's corporate philosophy of "the best house on the square", Bahnhofstrasse 14 is also distinguished by its exceptionally good location within Plauen. Embedded in the pedestrian zone and in the immediate vicinity of important national and international chain stores, the building is in a sought-after frequency location, from which current tenants, such as Ernsting's Family, benefit. Thanks to the prime location in Plauen, it has always been possible to retain tenants with good credit ratings for the long term.

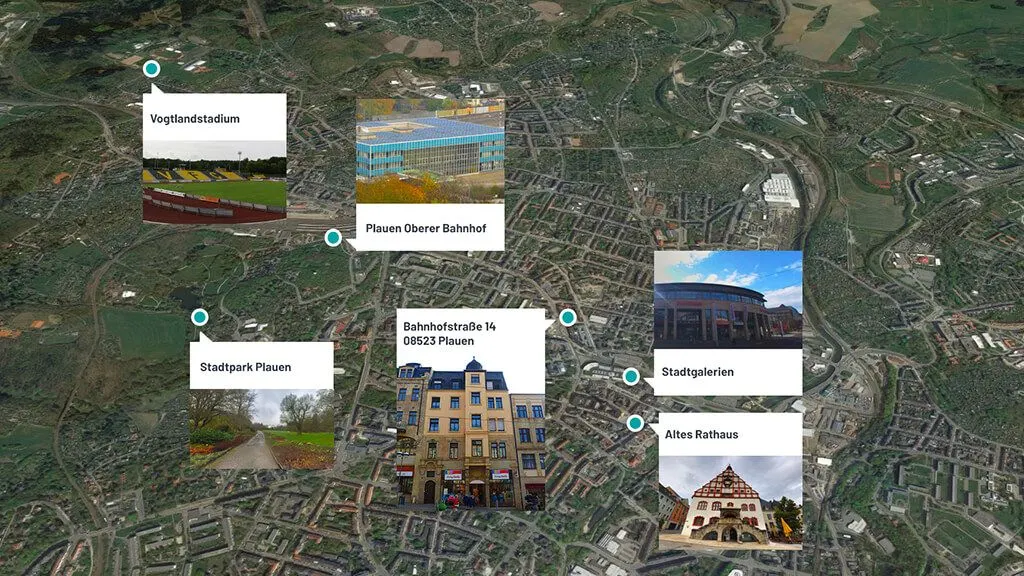

Explore the surroundings

Old Town Hall

The Old Town Hall was first mentioned in documents in 1382, but since there is evidence of mayors and sworn citizens as early as 1329, it was probably built earlier. Today it is the most important landmark of Plauen. The town hall has been rebuilt several times. Between 1503 and 1508 a late gothic building with curtain arch windows was built. During the town fire of 1548, the town hall was also severely damaged. The north wing with the burgher's hall was preserved, but the south gable burned down. Reconstruction began in the same year, with the Renaissance gable, which still exists, being added to the late Gothic substructure.

Plauen City Gallery

With a total of 80 shops spread over a retail area of 14,000 m², Stadt-Galerie Plauen is the largest shopping centre in Plauen's inner city location. In addition to the various specialist shops, the shopping centre also offers a wide range of culinary delights for visitors and residents. Furthermore, the shopping mall with international format and flair is an important economic factor in the region and the most important local supplier for the entire city.

Plauen upper station

Plauen railway station is the largest railway station in the city of Plauen. It is the central hub of rail traffic in the Vogtland region and is maintained and operated by Deutsche Bahn. The six tracks are used for both regional and long-distance trains. Adjacent to the station is also the bus station, which serves as a stop for regional and national bus lines.

City parking plazas and the Bärenstein Tower

The city park of Plauen is located not far from the city centre and offers the inhabitants both an extensive local recreation area and a theatre. Since 1964, Plauen's park theatre has been located in the city park with about 5,000 standing and 2,000 sitting places and represents a unique event area in the region. On the directly adjacent grounds there are sales stands and various other supply facilities. The Bärenstein Tower in Plauen's municipal park takes its name from the mountain of the same name on which it stands. The Bärenstein is the second highest mountain of Plauen with 432 meters. Already in 1906 a first observation tower was built. In 1995 the Rotary Club of Plauen started an initiative to build a new tower and an architectural competition was announced. In July 1997, on the Day of the Saxons, the present Bärenstein Tower was inaugurated and has been enthroned above the city ever since. At a height of 24.3 metres, the Bärensteinturm offers visitors a unique view over the city.

Vogtlandstadium and open-air swimming pool

The Vogtlandstadion in the north of Plauen is primarily the home ground of the top league football club VFC Plauen. The stadium is also used as an athletics stadium and is the largest open-air sports area in the city. Events are regularly held on the grounds belonging to the stadium. Adjacent to the stadium is the Haselbrunn outdoor swimming pool, which offers cooling and relaxation from everyday stress in summer.

Team

Many years of real estate and financing experience in Germany

All in all, the management team of the MAGAN Group around the managing director and owner Alexander Neuhuber has decades of experience in the real estate industry, especially in Berlin and the new German states.

MAGAN Managing Director Alexander Neuhuber is one of the most well-known and distinguished real estate entrepreneurs in Austria. Already in 1988 he founded his first real estate agency "Neuhuber und Partner". In the early 1990s, Neuhuber succeeded in taking over the Austrian general representation of DTZ (Debenham Thorpe Zadelhoff, later Debenham Tie Leung), one of the largest global real estate consulting companies. In 2001, he sold the company, then ranked third in the list of the largest Austrian commercial real estate agents, to his British partners. Originally founded as a pure holding company for investments, Magan Holding GmbH was then the operative company of the group for a long time. In order to define the business areas even more clearly and to express this in the company name, Magan Holding GmbH will be renamed Magan Advisors GmbH in autumn 2018. With this company he advises a top-class clientele on the selection and execution of real estate transactions, as an investor or owner representative. A unique selling point is the support of Austrian investors in their purchases and sales in Germany. Since 2004 Neuhuber has also been active with the Magan group of companies in Berlin and the new federal states, and since 2014 he has also been operating a Magan office in Leipzig. The second pillar of the Magan Group can be described as private equity/club deals. In this context, real estate is purchased, managed and finally also sold again within the framework of changing investment companies, with various partners, on their own account.

Since autumn 2017 DI(FH) Michael Alexander Mitterdorfer has taken over the management of transaction management and investment of the MAGAN Group and can look back on more than 10 years of professional experience in the real estate industry. Through his career with well-known real estate companies such as EHL, Bank Austria Real Invest and BAR, he has been able to continuously expand his investment know-how and his international network. He was able to expand his German expertise most recently as head of real estate acquisition at Immowert Immobiliengruppe. As transaction manager he is responsible for the selection and execution of real estate transactions within the MAGAN group of companies and for MAGAN clients.

From 2005 to 2007, Mr. Neuhuber and his partner, the Austrian Stumpf Group, jointly acquired almost 70 apartment buildings in Berlin, Potsdam and Leipzig as part of a private equity investment. This resulted in a portfolio with approximately 1,500 existing units (Spree eins and two GmbHs and Wannsee GmbH). Following a phase of property optimisation and management, the sale of approx. 600 condominium apartments and the remaining properties in global sales will follow between 2011 and 2014. From the beginning of 2014, MAGAN and a new partner (Trabi Immobilien) purchased apartment buildings in Leipzig, Dresden, Halle and other cities. By summer 2016, a total of 33 properties in the new German states had been acquired and managed. In 2017 the portfolio was sold globally to a German institutional investor. Since 2016, the MAGAN Group has been acquiring mainly residential apartment buildings in the target markets through new private equity companies, the Horch Group. To date, more than 30 properties have been purchased, and a partial package in Leipzig was already sold again at the end of 2018.

An additional, newer pillar of MAGAN is the Wartburg Group, with which individual condominiums are acquired - again in the form of a club deal. By the beginning of 2020, more than 120 condominiums have already been purchased in the cities of Leipzig, Dresden, Chemnitz, Magdeburg, Halle, Chemnitz, Zwickau, and Gera.

MAGAN Gruppe